Exclusive benefit for Patreon supporters

The Discipline of Warren Buffett. Automated.

As a thank you for supporting my work, Patreon members get exclusive access to our premium investment research platform—the same tools I use to find wonderful companies at fair prices.

Instant access when you become a member

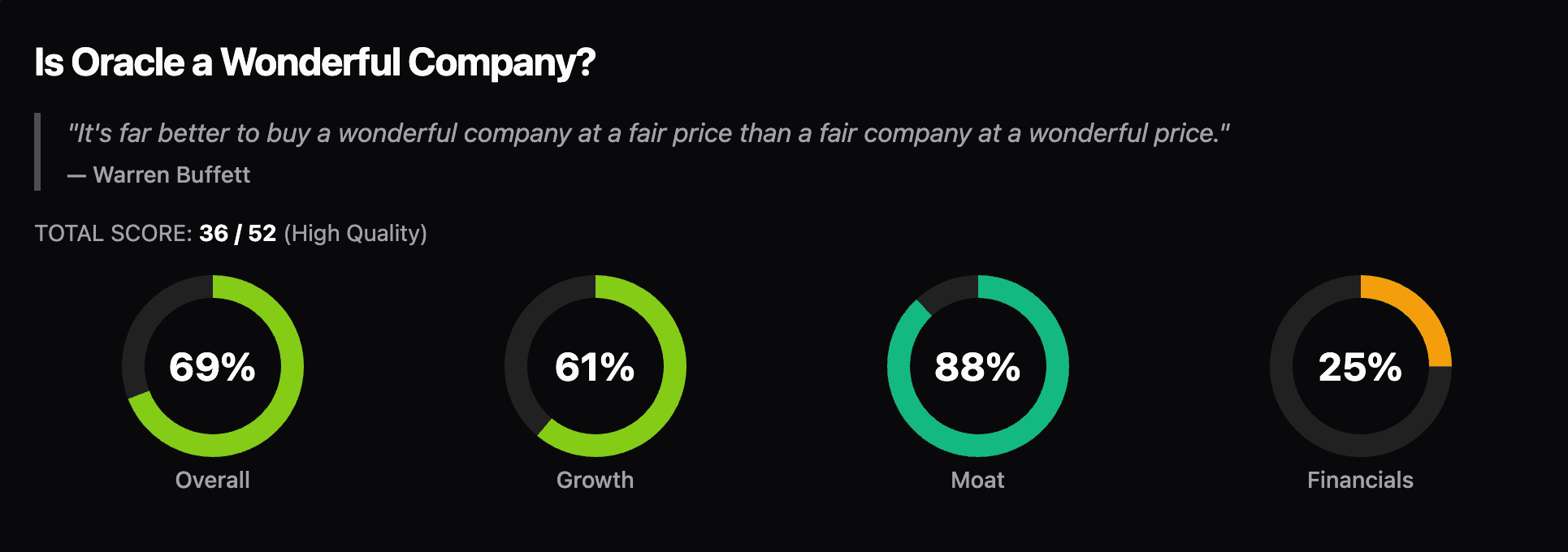

Identify Great Businesses Fast

Our proprietary 26-metric Coffee Can scores rank more than 1,500 companies on data designed to reveal businesses with durable economic moats.

Growth Metrics

- Revenue growth (1Y, 3Y, 5Y, 10Y)

- EXCLUSIVE: Owner's earnings growth (1Y, 3Y, 5Y, 10Y)

- EXCLUSIVE: Growth consistency

Moat Metrics

- EXCLUSIVE: Owner's earnings on invested capital

- EXCLUSIVE: Gross profits to assets

- Gross margin

- Operating margin

- ROE (TTM, 10Q avg, 10Y avg)

- ROA (TTM, 10Q avg, 10Y avg)

- ROIC (TTM, 10Q avg, 10Y avg)

Financial Strength

- Interest coverage ratio

- EXCLUSIVE: Shareholder yield

- Debt to equity

- Preferred stock outstanding

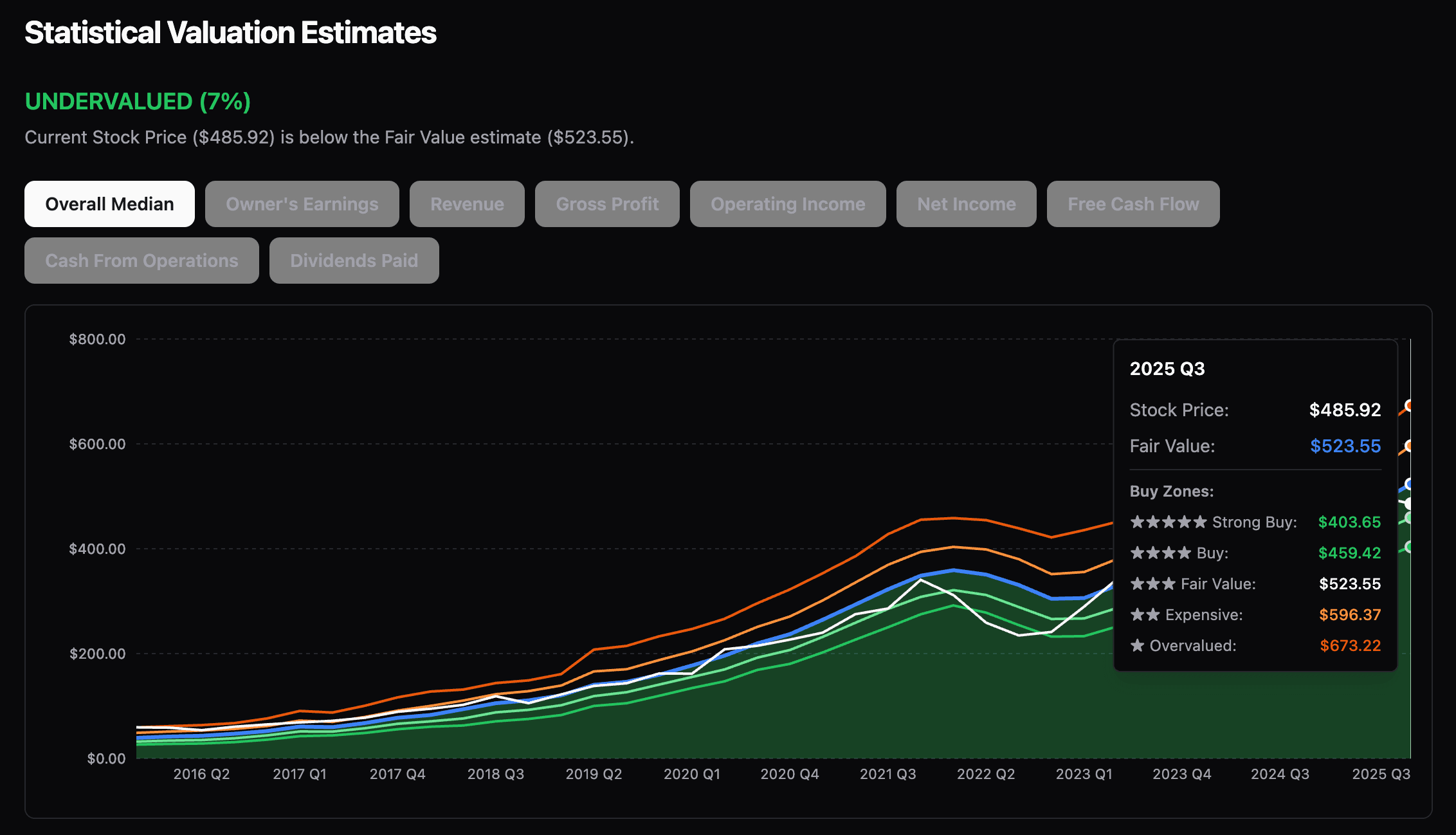

Measure what matters. Value it fast.

Multi-metric valuation models trained on decades of market data to surface fair value quickly.

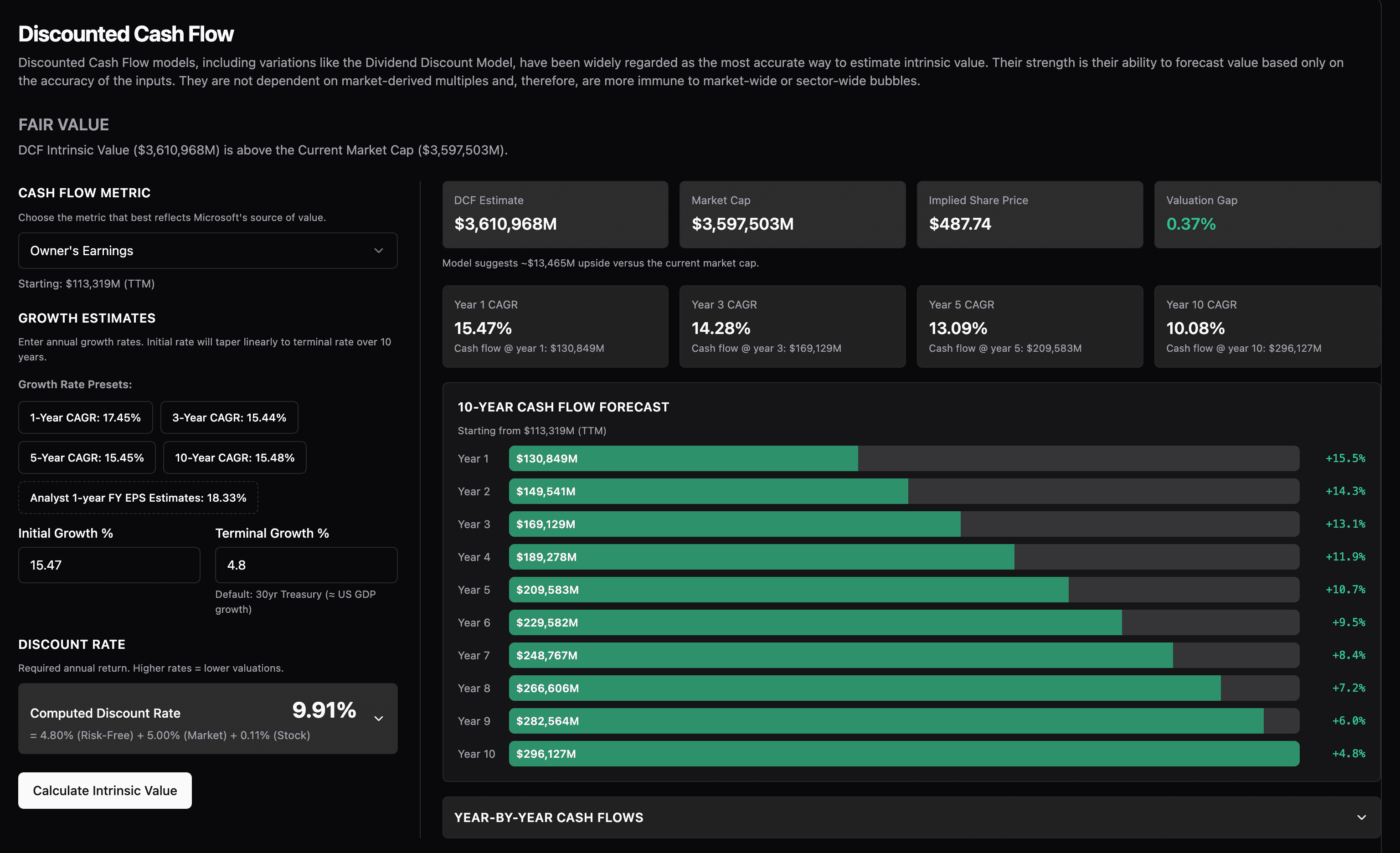

Instant Discounted Cash Flow Valuations

The world's fastest discounted cash flow calculations benchmarked against market realities.

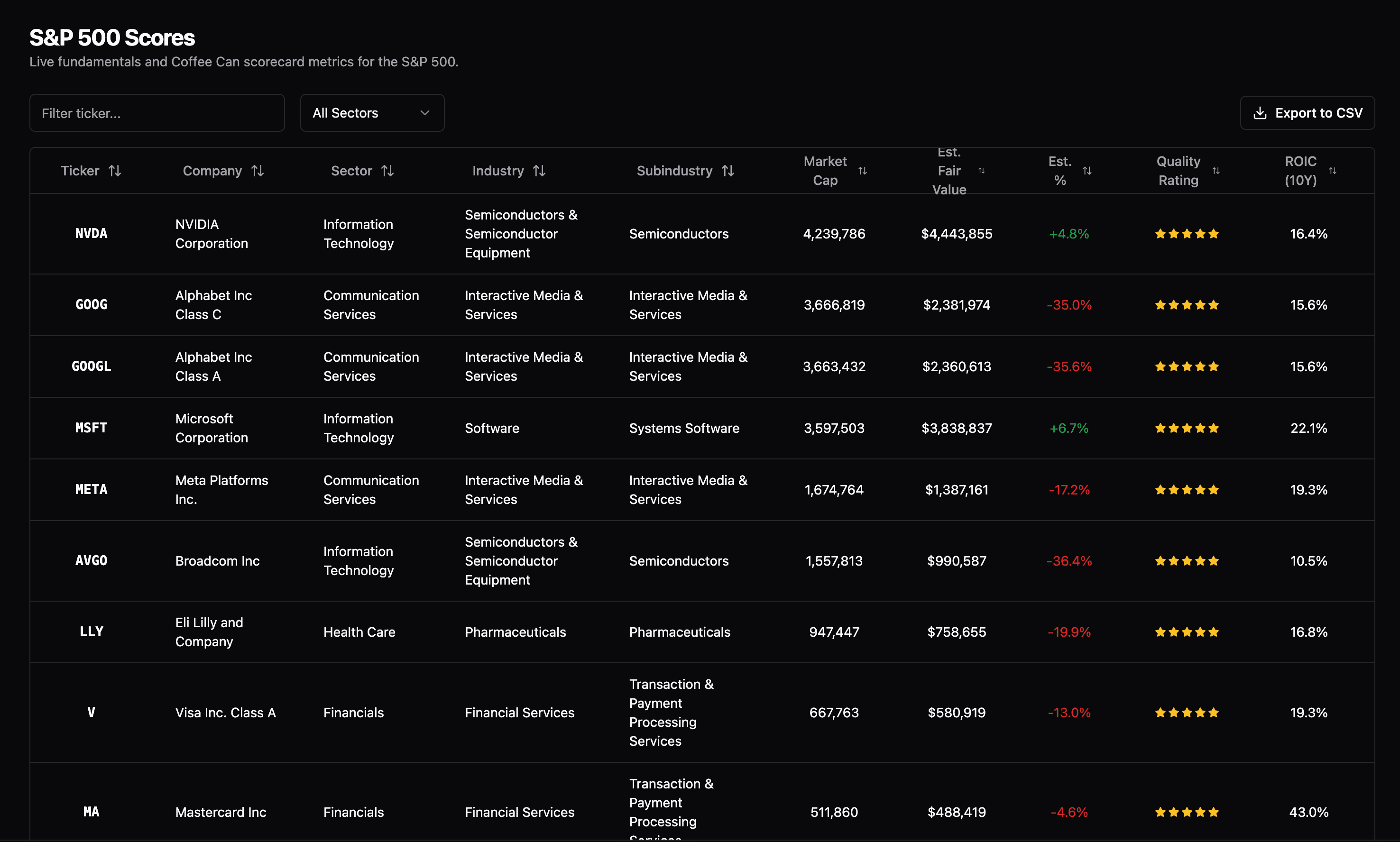

Index Rankings

Ranks each company in the S&P 500, Dividend Aristocrats, S&P 600 (small caps), and S&P 400 (mid caps) from top-to-bottom. Find the highest-quality investment candidates for each category in minutes.

More Than Just a Platform

When you join on Patreon, you're not just getting a tool—you're joining a community and supporting independent research.

Support Independence

No ads, no affiliate deals, no conflicts of interest. Your support keeps the research honest and unbiased.

Join a Community

Connect with hundreds of like-minded long-term investors who share your philosophy and approach.

Exclusive Content

Get Patreon-only posts, early access to research, and direct interaction that free followers don't see.

Based on the Principles of Legendary Investors

"Price is what you pay; value is what you get."

—Warren Buffett

"A great business at a fair price is superior to a fair business at a great price."

—Charlie Munger

Join the Community

Support my research and educational content on Patreon, and get full access to the Coffee Can Investing platform as an exclusive member benefit.

YouTube Follower

Free educational content on investing

Patreon Supporter

Full platform access + exclusive content

Already a Patreon member? Sign in here using the same email as your Patreon account.

Meet Your Guide

My name is Nathan Winklepleck, CFA. I'm a full-time investment analyst, an Amazon #1 Best Selling author, and host of a popular investing YouTube channel with thousands of subscribers learning to invest the Buffett way.

I built Coffee Can Investing because I wanted to share the exact tools I use for my own research. Your Patreon support makes this possible—it allows me to keep creating independent, unbiased research and educational content without relying on ads or affiliate deals.

Ready to invest like the legends?

Join hundreds of serious long-term investors on Patreon who use Coffee Can Investing to identify wonderful businesses at fair prices.

Instant platform access • Cancel anytime • Support independent research